On October 15, 2025, the Federal Ministry of Finance (BMF) published a letter (BMF letter) that is important for all companies that receive or send electronic invoices.

For the first time, it clearly distinguishes between format errors, business rule errors and content errors – and what each means for the validity of an invoice.

Many companies are now asking themselves:

When must an e-invoice be rejected?

When can it be accepted?

And what happens if the file is technically valid but the content is incorrect?

This article summarizes the BMF letter in easy-to-understand language and uses examples to show what you need to pay attention to in future.

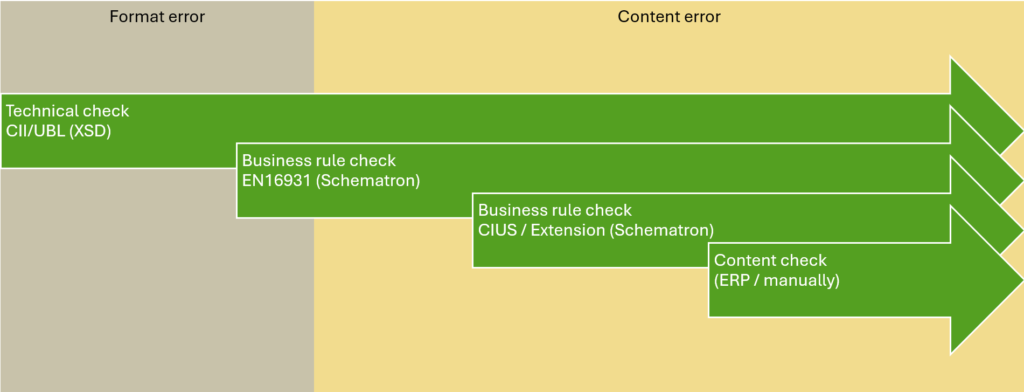

1. Multi-stage verification of an e-invoice

The BMF distinguishes between three stages of the audit:

- Format check – is the file technically correct and does it comply with the business rules of the European standard EN 16931?

- Content check with regard to correctness – is the mandatory information according to the VAT Act (Sections 14 and 14a UStG) correct?

- Other content check – does the invoice correspond to the selected format (e.g. XRechnung, ZUGFeRD) and is it mathematically and factually correct?

Were the services rendered or goods delivered actually invoiced – and was the correct tax case applied?

Only if all three levels are fulfilled is it a completely error-free e-bill.

2. Format error – the basic technical case

A format error exists if the file does not meet the requirements of EN 16931 or is not machine-readable.

In this case, it is not an e-invoice, but an “other invoice in another electronic format”.

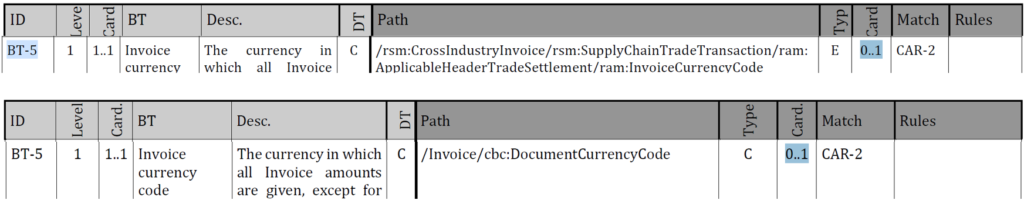

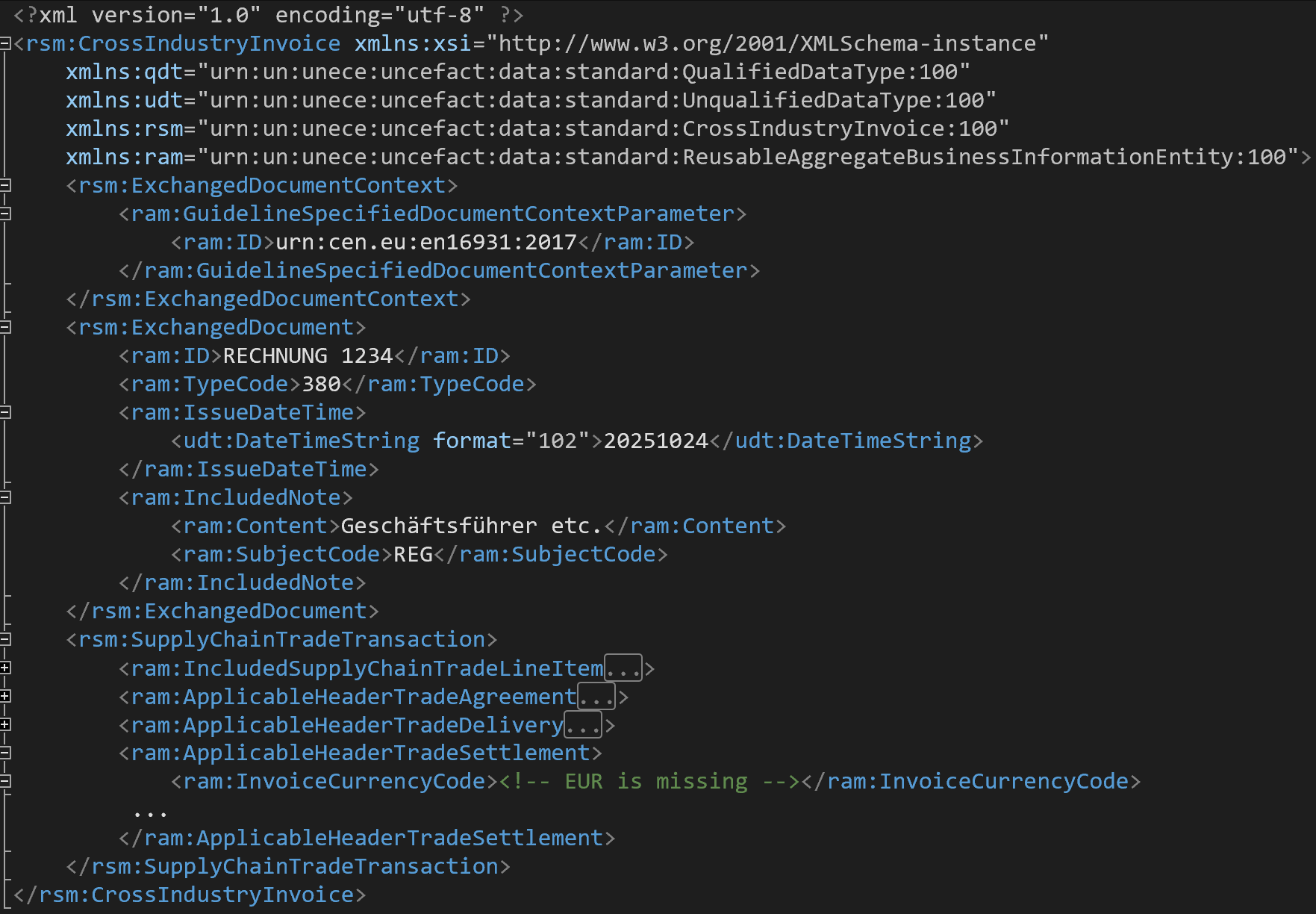

Example: Missing currency

Example: In EN 16931, the currency must be specified. If it is missing in the XML file, there is a format error – even if UBL or CII do not technically issue an error message.

BR-5: An invoice must have a code for the invoice currency (BT-5).

EN16931-1:2017

Neither CrossIndustryInvoice nor UBL technically require the currency to be specified:

The example shows that the European standard EN 16931 stipulates a clear obligation to specify the invoice currency (BT-5) – cardinality 1..1 means that this field must be present exactly once.

In the underlying syntaxes CII and UBL, however, the field is only defined as 0..1 and is therefore technically optional.

This means that an XML file can also be formally valid without a currency specification, but does not meet the technical requirements of EN 16931.

In practice, this leads to a format error, as the invoice is not fully compliant with the standard – even if it is structured correctly from a technical perspective.

The consequence: it is not an e-invoice, but another electronic invoice that may only be accepted with the recipient’s consent.

Consequence: During the transitional period (until the obligation to send), the recipient may accept such an invoice, but is not obliged to do so.

As soon as the invoice sender is obliged to issue an e-invoice, the recipient must reject format error invoices.

3. business rule errors – the link between technology and content

So-called business rules are defined in the European standard EN 16931 and in the formats based on it, such as XRechnung and ZUGFeRD.

These rules describe which information must be present in an e-invoice and how they are logically interrelated.

An example:

If an invoice contains a tax rate, the corresponding tax amount must also be specified.

Or: If a discount value is specified, the reason for the discount must not be missing.

A large proportion of these business rules can be checked technically – that’s exactly what validation tools do: automatically check the correlations.

Other rules – such as those relating to economic plausibility or tax interpretation – must be checked manually or with the support of an ERP system.

The business rules support both levels

Business rules play a role in two phases of the audit:

- During the format check

You ensure that the file is technically correct and compliant with EN 16931.

If an error is detected here, this is referred to as a format error.

→ Example: A mandatory entry in the standard is missing or in the wrong place. - The content check

helps you to identify whether the content of the invoice is consistent and complete – i.e. whether the information matches logically and meets the VAT requirements.

→ Example: The seller’s address is not complete. EN 16931 itself only requires the name and country to be stated.

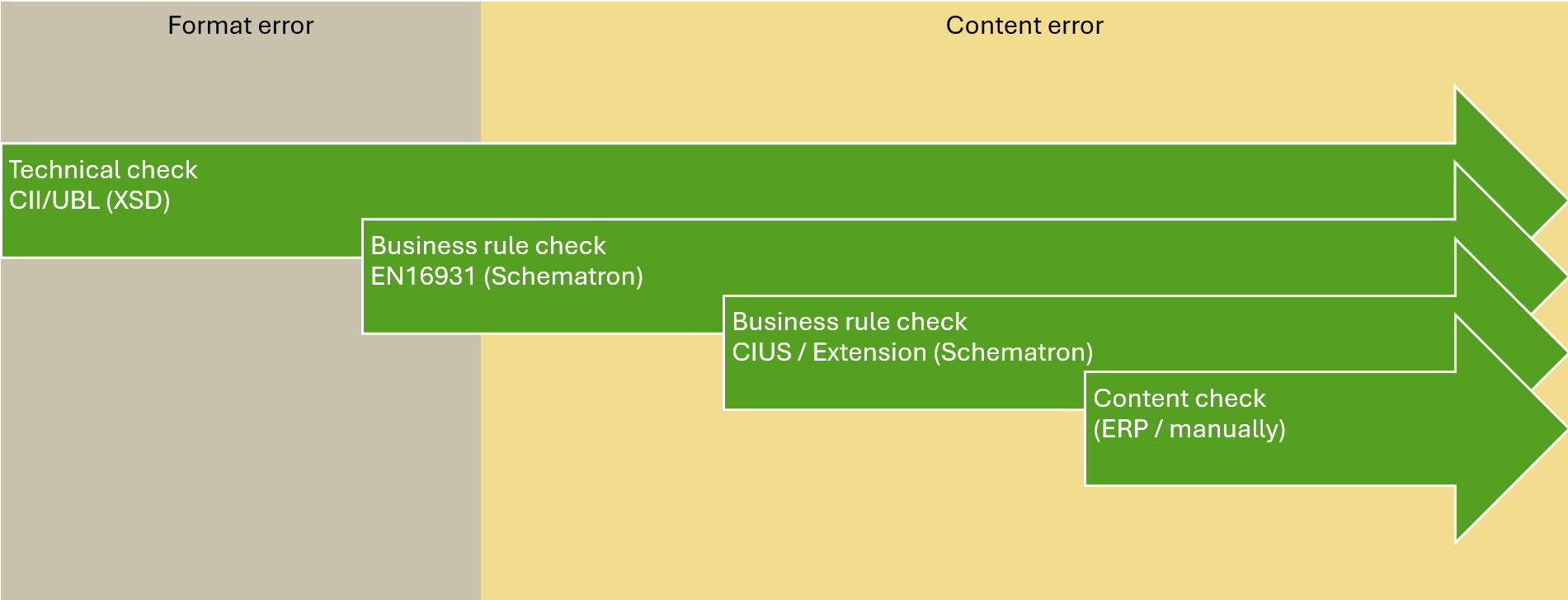

The four test stages at a glance

The technical and content validation builds on each other step by step:

- Technical inspection – CII/UBL structure (XSD)

- Business rule check EN 16931 – European basic rules

- Business rule check CIUS / extension – national or industry-specific additions (e.g. XRechnung, ZUGFeRD)

- Content check – ERP system or manual

The technical validation in accordance with CII/UBL in accordance with EN 16931 is carried out step by step using business rule checks before the final content check takes place.

4. Content errors – factual, arithmetical or vat related errors

Content errors relate to the actual content of the invoice.

They are always present if the invoice is incorrect in terms of tax, calculation or content – for example, if it contains incorrect amounts, tax rates or service details.

However, not every content error automatically means that an invoice is not proper within the meaning of the VAT Act.

An improper invoice in accordance with Section 14 UStG only exists

if the legally prescribed mandatory information in accordance with Sections 14 and 14a UStG is incomplete or incorrect.

Technically and professionally verifiable content

- Technically verifiable content

Some of the content errors can be detected via business rules that are automatically checked by validation tools.

These include, for example:- Inconsistencies between tax rate and tax amount

- Missing mandatory fields such as invoice date or recipient address

- Invalid values from code lists (currencies, countries, units of measure)

- Content to be checked technically or manually

Other content cannot be checked automatically, but must be evaluated by the ERP system or a manual check.

These include- Whether the invoiced service was actually provided

- Whether the correct tax case has been selected

- Whether the amounts are mathematically correct

Technically verifiable content is documented by validation tools in a validation report.

Examples of content errors

- Incorrect or missing tax amount

- Incorrect tax rate or incorrect tax exemption

- Incomplete service description

- Incorrect issue date

- Incorrect or missing tax number / VAT ID no.

- Incorrect quantities, prices or totals

Classification

- Content error = the invoice is incorrect in terms of tax, calculation or content

- Non-conforming invoice (§ 14 UStG) = mandatory information is incomplete or incorrect

This means:

An invoice can be incorrect in terms of content but still be correct for VAT purposes – for example if the price is incorrect, as long as all mandatory information is present and correct.

Conversely, missing mandatory information (e.g. missing VAT ID number or tax number of the seller) is always a defect relevant for VAT purposes.

5. acceptance or rejection of an e-bill

According to the BMF letter dated October 15, 2025, the decision as to whether an electronic invoice must be accepted or rejected depends on the type of error.

The decisive factor is whether there is a format error, a content error or a non-conforming invoice in accordance with the UStG.

Step 1 – Format check

The first step is to check whether the file meets the technical and formal requirements of EN 16931.

- Result: e-invoice

The file is technically correct and contains all mandatory information in accordance with EN 16931 → Continue with the content check. - Result: Other electronic invoice

The file contains format errors (e.g. mandatory fields are missing or in the wrong place).- If the invoice sender is not yet obliged to issue an e-bill, the recipient may accept or reject it.

- If the sender is already obligated, the recipient must reject the invoice, as it is not an e-bill in the legal sense.

Step 2 – Content check

The system then checks whether the invoice is correct in terms of tax, calculation or content.

Content errors can be detected both technically and manually.

- Technically or rule-based checkable content

– Check via business rules (validation tool)

– Typical errors: incorrect tax rates, invalid code list values, missing mandatory fields

– Result: usually automatic error message in the validation report - Content to be checked technically or manually

– Check in the ERP system or by visual inspection

– Typical errors: incorrect tax case, incorrect amounts, incorrect service description

– Result: Content errors that may or may not be relevant for tax purposes

Step 3 – Assessment of compliance and civil law requirements

An invoice is only considered improper,

if a legally prescribed mandatory information according to §§ 14 or 14a UStG is missing or incorrect.

- Incorrect invoice → Obligation to reject

(e.g. missing tax number, incomplete address of the buyer, incorrect tax rate) - Other content error → civil law review required

(e.g. incorrect price, incorrect order number)

Other content errors Errors are irrelevant for VAT purposes, but can still be relevant under civil law.

If the use of a specific format (e.g. XRechnung) has been agreed between the sender and recipient,

the business rules and mandatory fields defined there should also be observed.

Example:

If the mandatory field BT-10 (customer reference number), which must be completed in the XRechnung, is missing,

the invoice can be rejected for civil law reasons,

although it is irrelevant for VAT purposes and can remain valid for tax purposes.

This means that not every content error is automatically a tax problem –

but it can still justify a contractual or organizational rejection.

Decision matrix

| Test type | Error type | Consequence |

|---|---|---|

| Format check | Format error | No e-Invoice → may or must be rejected (depending on whether the sender is obliged to issue an e-invoice) |

| Content check (technical) | Business rule violation EN 16931 / CIUS | Technical content error → Correction recommended |

| Content check (technical) | Fiscally, arithmetically or factually incorrect | Content error → internal clarification or rejection |

| VAT audit | Mandatory information missing or incorrect | Invoice not in order → Rejection required |

| Civil law examination | Agreed format obligations violated (e.g. XRechnung, ZUGFeRD) | Irrelevant for VAT purposes, but rejection based on civil law possible |

Recommendation for practice

- Use a validation tool that covers format and business rule checks according to EN 16931.

- Supplement a manual or ERP-supported check to identify factual and tax errors.

- Take into account contractual or civil law agreements on the invoice format used (e.g. XRechnung).

- Keep validation reports – they serve as proof of your due diligence vis-à-vis the tax office.

6 From the BMF letter and disclaimer

The following passages are taken from the BMF letter dated October 15, 2025 and explain

how format errors and content errors are to be understood in legal terms.

Format error

Rn 6a

1 A file [with] […] format errors […] constitutes […] another invoice in a different electronic format.

2 Format errors exist if the invoice file does not […]

3 […] meet the requirements of Section 14(1) sentence 6 UStG.

§ Section 14 (1) sentence 6 VAT Act defines permissible formats:

- a) formats that comply with the European standard EN 16931 and its syntaxes UBL and CII and

- b) interoperable formats that support the future reporting system.

Meaning:

A file with format errors does not meet the technical requirements of EN 16931.

It is therefore not considered an e-invoice, but another electronic invoice.

Format errors initially only lead to a statement as to whether the invoice is an e-invoice or another electronic invoice –

but not as to whether the invoice is correct for tax purposes.

Content errors – recitals 6b and 35a

Rn 6b

1 […] (business rule error) […]

2 [.] are present if the invoice file violates the business rules applicable to this e-invoice format.

margin no. 35a

1 In the event of a breach of the mandatory VAT information in Sections 14 (4) and 14a UStG, the invoice is not in order […] .

2 Such [.] (content errors) can be detected in an e-bill [.] as a violation of the [.] business rules […].

3 Business rule errors regarding other content […] are irrelevant for VAT purposes.

4 Content errors may […] exist if […] there is no violation of the business rules and […] no error was detected [during] the validation.

5 Validation of the e-invoice does not replace the recipient’s obligation to check the invoice for completeness and accuracy […], but supports him in this.

6 An entrepreneur can rely on the technical result of a validation (with regard to the format and business rules) by means of a suitable validation application if the due diligence obligations of a prudent businessman are observed.

7 It is advisable to keep the validation report as proof.

Significance:

- Business rule errors are violations of the rules defined in EN 16931 or a CIUS/extension (e.g. XRechnung, ZUGFeRD).

- Content errors exist if the invoice is incorrect in terms of tax, calculation or content.

- Only if mandatory information according to § 14 UStG is missing or incorrect is the invoice not in order.

The BMF also clarifies:

“Business rule errors relating to other content are irrelevant for VAT purposes.”

This means:

Not every error automatically leads to a loss of input tax deduction.

A technically or organizationally incorrect but fully completed invoice can still be correct for VAT purposes.

Obligations of the recipient

“Validation of the e-invoice does not replace the recipient’s obligation to check the invoice for completeness and accuracy, but supports them in doing so.”

“An entrepreneur can rely on the technical result of a validation (with regard to the format and business rules) by means of a suitable validation application if the due diligence obligations of a prudent businessman are observed. As proof, it is advisable to keep the validation report.”

Conclusion:

companies may rely on the result of a suitable validation tool –

but they remain obliged to check the content of the invoice.

The validation report serves as important evidence in the context of due diligence.

Disclaimer

Note:

The statements made in this article are made to the best of our knowledge and belief.

However, they do not constitute tax or legal advice and are therefore non-binding.

For a binding assessment, please contact your trusted tax advisor or lawyer.